This guide demonstrates the “1,000 Baht Trap” in action, a common scenario where a simple transaction in Thailand costs nearly $10 more than it should. To find the cheapest way to pay in Thailand, we put seven payment methods to the test – from cards to cash to ATMs – to give you a definitive, data-driven answer for your trip.

The 1,000 Baht Trap: A $10 Mistake on a $30 Transaction

To illustrate how much your payment choices matter, let’s run a simple experiment: how much does it really cost in US Dollars to either get 1,000 THB in cash or pay for a 1,000 THB item? The difference between the best and worst methods will be surprising.

For this demonstration, we are using the following real-world exchange rates as of July 8, 2025:

- Mid-Market Rate:

1 USD = 32.54 THB(The baseline rate used by card networks and services like Wise). - Superrich Exchange Rate:

1 USD = 32.44 THB(A top-tier “buy” rate for exchanging USD cash). - Thai Bank ATM Fee:

220 THB(A fixed fee charged by all major Thai banks for foreign card withdrawals).

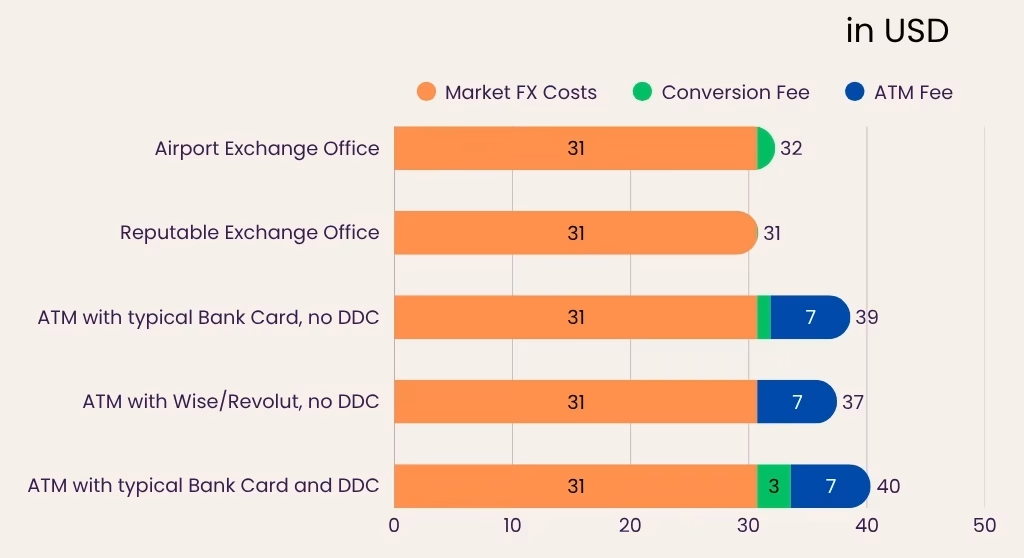

Part 1: Scenarios for Getting 1,000 THB in CASH

These scenarios explore the different ways to obtain physical Thai Baht and the associated costs.

Scenario 1: The Unprepared Tourist (Airport Exchange)

You exchange USD for 1,000 THB at a standard, less competitive airport bank counter.

- Method: Exchanging USD cash at a typical airport counter.

- The Cost Factor: A poor exchange rate (e.g., 31.00 THB/USD). (Possible withdrawal costs in the country of origin for the USD cash excluded)

- Calculation: 1,000 THB ÷ 31.00 THB/USD = $32.26 USD.

- Result: It costs you $32.26 USD to get 1,000 THB.

Scenario 2: The Savvy Cash Exchanger (Superrich)

You go to a reputable exchange office like Superrich.

- Method: Exchanging USD cash at the Superrich counter.

- The Cost Factor: The competitive exchange rate of 32.44 THB to 1 USD. (Possible withdrawal costs in the country of origin for the USD cash excluded)

- Calculation: 1,000 THB ÷ 32.44 THB/USD = $30.83 USD.

- Result: It costs you $30.83 USD to get 1,000 THB.

Scenario 3: The Standard ATM User (with a typical bank card)

You use your home bank’s debit card (with a 3% foreign transaction fee) at a Thai ATM, correctly declining DCC.

- Method: ATM withdrawal with a standard debit card (with fees).

- The Cost Factor: The flat 220 THB ATM fee plus your home bank’s 3% foreign transaction fee.

- Calculation: ((1,000 THB + 220 THB) ÷ 32.54 THB/USD) * 1.03 = $38.61 USD.

- Result: It costs you $38.61 USD to get 1,000 THB.

Scenario 4: The Modern Traveler (Wise/Revolut ATM Withdrawal)

You use your Wise/Revolut card at a Thai ATM, correctly declining DCC.

- Method: ATM withdrawal using a low-fee multi-currency card.

- The Cost Factor: The mid-market exchange rate, but you still pay the 220 THB Thai ATM fee.

- Calculation: (1,000 THB + 220 THB) ÷ 32.54 THB/USD = $37.49 USD.

- Result: It costs you $37.49 USD to get 1,000 THB.

Scenario 5: The Worst-Case ATM User (The DCC Trap)

You use an ATM and accept the machine’s offer to convert the transaction to USD for you.

- Method: ATM withdrawal accepting Dynamic Currency Conversion (DCC).

- The Cost Factor: A terrible exchange rate (e.g., 7% worse than market: 30.26 THB/USD) plus the 220 THB ATM fee.

- Calculation: (1,000 THB + 220 THB) ÷ 30.26 THB/USD = $40.32 USD.

- Result: It costs you a massive $40.32 USD to get 1,000 THB.

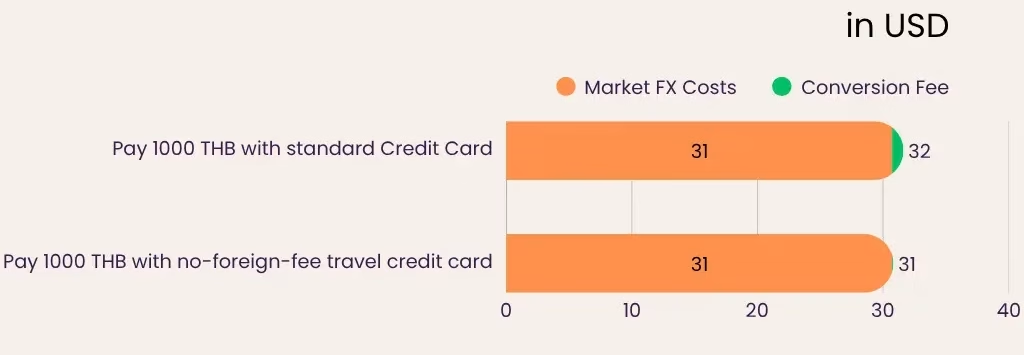

Part 2: Scenarios for Paying by CARD for a 1,000 THB Item

These scenarios explore the costs of paying directly for a 1,000 THB purchase with a card.

Scenario 6: The Standard Card User (Bad Card Purchase)

You pay for a 1,000 THB item with a credit card that charges a 3% foreign transaction fee.

- Method: Direct card payment with a high-fee credit card.

- The Cost Factor: Your bank’s 3% Foreign Transaction Fee.

- Calculation: (1,000 THB ÷ 32.54 THB/USD) * 1.03 = $31.65 USD.

- Result: Your 1,000 THB purchase costs you $31.65 USD.

Scenario 7: The Smart Card User (Travel/Fintech Card Purchase)

You pay for a 1,000 THB item with a Wise, Revolut, or no-foreign-fee travel credit card.

- Method: Direct card payment with a no-fee card.

- The Cost Factor: None. You get the pure mid-market exchange rate.

- Calculation: 1,000 THB ÷ 32.54 THB/USD = $30.73 USD.

- Result: Your 1,000 THB purchase costs you $30.73 USD.

Summary of the 1,000 Baht Challenge

| Scenario | Method | Final Cost in USD |

|---|---|---|

| Paying by Card for an Item (1,000 THB) – The Best Options | ||

| 7: Smart Card User | Direct Payment (0% Fee) | $30.73 |

| 6: Standard Card User | Direct Payment (3% Fee) | $31.65 |

| Getting Cash (1,000 THB) – The More Expensive Options | ||

| 2: Savvy Cash Exchanger | City Exchange (SuperRich) | $30.83 |

| 1: Unprepared Tourist | Airport Exchange | $32.26 |

| 4: Modern Traveler (Wise/Revolut) | ATM Withdrawal (Market Rate + ATM Fee) | $37.49 |

| 3: Standard ATM User | ATM Withdrawal (+ FTF + ATM Fee) | $38.61 |

| 5: Worst-Case ATM User (DCC Trap) | ATM Withdrawal (DCC Rate + ATM Fee) | $40.32 |

The scenarios above clearly show that how you access your money matters significantly. The difference between the best method (Scenario 7 at $30.73) and the worst (Scenario 5 at $40.32) is nearly $10 for the same 1,000 THB value. The following sections explain the key factors behind these results.

Understanding the Factors Behind the Scenarios

“By failing to prepare, you are preparing to fail.” – Benjamin Franklin

Your financial preparation determines which scenario you will experience. The key factors are exchange rate spreads and fees.

Factor 1: Exchange Rates (Card vs. Cash)

Using a fee-free card is the ultimate winner because it gives you the pure mid-market rate. This is why the Smart Card User (Scenario 7) achieved the lowest cost of $30.73. When exchanging physical cash, even at a top-tier provider like Superrich, there is a small “spread,” making it slightly more expensive, as seen with the Savvy Cash Exchanger (Scenario 2) at $30.83. The worst rates are found at standard airport counters, costing the Unprepared Tourist (Scenario 1) a higher $32.26.

Factor 2: The ATM Fee Trap

All ATMs in Thailand charge a mandatory 220 THB fee for foreign cards. This fixed cost makes withdrawing small amounts of cash incredibly inefficient. As seen in Scenarios 3, 4, and 5, this single fee immediately pushed the cost of getting 1,000 THB to over $37, regardless of the card used. This proves that ATMs should only be used for larger withdrawals where the fee becomes a smaller percentage of your total transaction.

Factor 3: Hidden Fees (Foreign Transaction Fees & DCC)

These two fees are the primary cause of overspending.

- Foreign Transaction Fees: This is the 1-3% fee your home bank charges. It’s the reason the *Standard Card User (Scenario 6) paid $31.65 while the smart user paid only $30.73. On a large trip, this fee adds up significantly.

- Dynamic Currency Conversion (DCC): This is the most damaging trap. When an ATM or card machine asks if you want to pay in USD, it’s an offer to use a terrible exchange rate. Accepting it is what caused the Worst-Case Scenario (Scenario 5), inflating the cost to a staggering $40.32. Always choose to be charged in THB.

Factor 4: The Right Tools (Fintech vs. Traditional Banks)

Modern fintech services like Wise and Revolut are designed to overcome these issues. They provide fee-free spending at the mid-market rate, which is how you achieve the best-case Scenario 7. While they can’t avoid the local 220 THB ATM fee (as seen in Scenario 4), they protect you from the extra foreign transaction fees your home bank would charge (Scenario 3).

Your Financial Strategy for Thailand

Based on the hard data from our 1,000 Baht Challenge, here is your optimal strategy:

- Pay with a Fee-Free Card Whenever Possible. This is the undisputed cheapest method, costing you only $30.73 for a 1,000 THB purchase (Scenario 7). Prepare by getting a Wise, Revolut, or no-foreign-fee travel credit card before your trip.

- For Cash, Exchange USD at a Reputable Booth. This is the second-best option and the cheapest way to get physical currency, costing $30.83 at a place like Superrich (Scenario 2). Avoid standard airport bank counters.

- Use ATMs Sparingly and for Large Amounts. The 220 THB fee makes this method expensive for small withdrawals. Always decline DCC to avoid the worst-case $40.32 cost (Scenario 5).

By understanding these scenarios, you can master your finances and focus on the amazing experiences Thailand has to offer, whether you’re exploring the vibrant shopping malls in Bangkok or enjoying tranquil beaches.

Reliable Resources

- Official Bank Websites: For current requirements and charges, consult major Thai banks like Kasikornbank, Siam Commercial Bank, and Bangkok Bank.

- Bank of Thailand (BOT): The central bank’s website provides official data on financial regulations and payment systems.

- Official Websites of Multi-Currency Providers: Always refer to Wise or Revolut’s official sites for their latest fee structures.